Understanding the Difference Between simple interest and compound interest

Are you confused about the concepts of simple and compound interest? These two fundamental principles play a significant role in the world of finance. Whether you’re borrowing money, making investments, or managing your personal finances, understanding the distinction between simple and compound interest is essential. In this comprehensive guide, we’ll delve into the meaning of each type of interest, explore their formulas, discuss their applications, and highlight their implications for borrowers and investors. Let’s embark on this financial journey!

Introduction to simple interest and compound interest

Interest is a fundamental concept in finance that refers to the cost of borrowing money or the return on investment. It plays a crucial role in determining the profitability of investments and the affordability of loans. There are two primary types of interest: simple interest and compound interest.

What is Simple Interest?

Simple interest is a straightforward method for calculating interest on a principal amount over a specific period. Unlike compound interest, which takes into account the accumulated interest, simple interest solely considers the initial principal.

Understanding the Simple Interest Formula

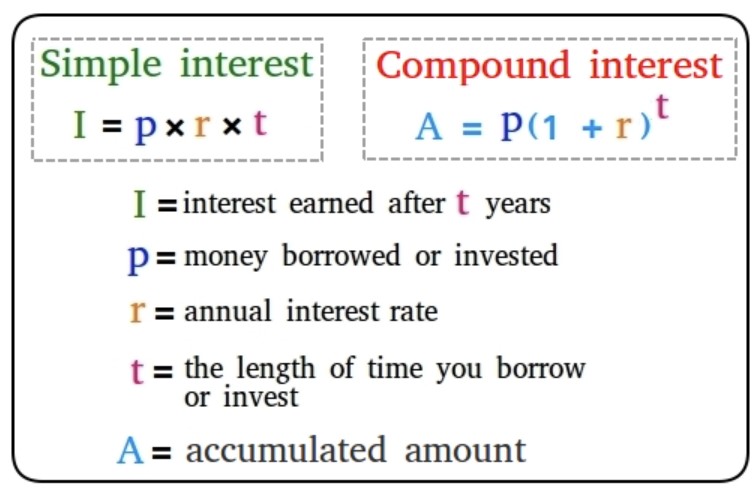

Calculating simple interest is remarkably simple, thanks to its straightforward formula:

Simple Interest (SI) = Principal (P) × Rate (R) × Time (T)

Here’s what each component of the formula represents:

– Principal (P): The initial amount of money borrowed or invested.

– Rate (R): The fixed interest rate, usually expressed as a percentage.

– Time (T): The duration for which the interest is calculated, often measured in years.

Advantages and Limitations of Simple Interest

Advantages:

1. Simplicity: Simple interest calculations are easy to understand and compute.

2. Predictability: Borrowers and investors can accurately predict interest payments or earnings.

3. Short-Term Loans: Simple interest is commonly used for short-term loans, making it suitable for immediate financial needs.

Limitations:

1. Lower Returns: In long-term investments, simple interest may yield lower returns compared to compound interest.

2. Doesn’t Account for Compounding: Simple interest doesn’t consider the effect of compounding, which can lead to missed opportunities for higher earnings.

What is Compound Interest?

Compound interest is a more complex form of interest that involves the calculation of interest not only on the initial principal but also on the accumulated interest over time.

Comprehending the Compound Interest Formula

The compound interest formula is as follows:

Compound Interest (CI) = P × (1 + R/n)^(nt) – P

In this formula:

– Principal (P): The initial amount of money borrowed or invested.

– Rate (R): The fixed interest rate, usually expressed as a decimal.

– Time (T): The duration for which the interest is calculated, often measured in years.

– n: The number of times interest is compounded per year.

Benefits and Drawbacks of Compound Interest

Benefits:

1. Higher Returns: Compound interest leads to exponential growth over time, resulting in higher returns compared to simple interest.

2. Long-Term Investments: It’s particularly advantageous for long-term investments, such as retirement funds.

Drawbacks:

1. Complexity: Compound interest calculations are more intricate than simple interest calculations.

2. Unpredictability: The compounding effect can make it challenging to predict exact returns.

Comparing Simple and Compound Interest

The key difference between simple and compound interest lies in the treatment of the accumulated interest. While simple interest only considers the initial principal, compound interest takes into account both the principal and the interest earned over time.

Real-World Applications of Simple and Compound Interest

Both simple and compound interest find applications in various financial transactions, such as loans, mortgages, and investments.

Choosing the Right Type of Interest for Your Needs

Deciding between simple and compound interest depends on your financial goals, investment horizon, and risk tolerance.

Calculating Interest with Online Tools

Online interest calculators simplify the process of determining interest payments and returns, providing quick and accurate results.

The Rule of 72

The rule of 72 can be quite helpful to anyone who wants to mentally calculate compound interest. For rough estimates rather than accurate calculations like those provided by financial calculators. It indicates that you can divide 72 by any interest rate to determine how many years (n) are needed to double a given amount of money.

n = 72/8 = 9

How long would it take ₹10,000 to double at an interest rate of 8%?

At 8% interest, it will take 9 years for the ₹10,000 to grow to ₹20,000 in value. Although it should also work quite well for anything below 20%, this formula performs best for interest rates between 6 and 10%.

FAQs About simple interest and compound interest

1. Which type of interest yields higher returns?

– Compound interest leads to higher returns, especially in long-term investments.

2. Are there any situations where simple interest is more advantageous?

– Simple interest is preferable for short-term loans or when predictability is essential.

3. Can I switch between simple and compound interest for my investments?

– The type of interest is usually predetermined based on the financial product or loan agreement.

4. How can I calculate compound interest with different compounding frequencies?

– Online calculators often allow you to customize compounding frequencies for accurate calculations.

5. Is there a maximum limit to the amount of interest earned with compound interest?

– No, compound interest continues to grow exponentially over time without an upper limit.

Conclusion: Making Informed Financial Decisions

In conclusion, simple and compound interest are two essential concepts in finance that impact borrowers and investors alike. While simple interest offers simplicity and predictability for short-term needs, compound interest provides the potential for significant long-term growth. Understanding the differences between these interest types empowers you to make informed financial decisions and optimize your investments and loans.