Sukanya Samriddhi yojana calculation table 2023: Empowering the Future of Girl Child Education

Introduction

In a country where the empowerment and education of girls hold immense importance, the Sukanya Samriddhi Yojana stands as a beacon of financial support and security for the future of girl children. This government-backed savings scheme has gained significant traction for its role in fostering a brighter and more secure tomorrow for young girls across India. In this comprehensive guide, we’ll delve into the key aspects, benefits, eligibility criteria, and the impact of Sukanya Samriddhi Yojana.

What is Sukanya Samriddhi yojana?

Sukanya Samriddhi Yojana is a government-initiated savings scheme that aims to promote the welfare and education of girl children in India. Launched under the ambitious “Beti Bachao, Beti Padhao” campaign, this scheme offers parents and guardians an exceptional opportunity to secure the financial future of their daughters. By encouraging systematic savings from an early age, Sukanya Samriddhi Yojana seeks to empower families and pave the way for the education and independence of young girls.

How Does the Scheme Work?

The working principle of Sukanya Samriddhi Yojana revolves around the creation of a dedicated savings account in the name of a girl child. Parents or legal guardians can open this account when the girl is below ten years of age. Regular contributions are made to this account, which accumulates over time and yields substantial returns. The maturity period of the account is 21 years from the date of opening, ensuring that the accumulated funds can be utilized for important life milestones such as education and marriage.

Benefits of Sukanya Samriddhi yojana

Financial Security

Sukanya Samriddhi Yojana offers a robust platform for building financial security for the girl child’s future. The disciplined savings approach ensures a substantial corpus over time, which can be instrumental in supporting higher education, career aspirations, and other essential needs.

Tax Benefits

Contributions made to Sukanya Samriddhi Yojana accounts are eligible for tax deductions under Section 80C of the Income Tax Act. This feature provides parents with a valuable avenue for reducing their tax liability while securing their daughter’s future.

High Interest Rates

One of the standout advantages of the scheme is the attractive interest rates offered. The interest is compounded annually and is often higher than other traditional savings options, making Sukanya Samriddhi Yojana a compelling choice for long-term wealth accumulation.

Long-Term Investment

Sukanya Samriddhi Yojana instills a sense of disciplined and systematic investment from an early age. The long-term nature of the scheme encourages parents to plan ahead and create a substantial financial cushion for their daughter’s future endeavors.

Eligibility Criteria

Age Requirements

Parents can open a Sukanya Samriddhi account for a girl child who is below ten years of age. This ensures that the scheme focuses on nurturing financial growth from a young and impressionable age.

Citizenship

The scheme is available to both resident and non-resident Indians. This inclusive approach allows families from various backgrounds to avail the benefits of Sukanya Samriddhi Yojana and secure their daughter’s future.

Opening a Sukanya Samriddhi Account

To open a Sukanya Samriddhi account, certain documents are required, including the girl child’s birth certificate and the parent or guardian’s identification proof. The account can be managed through designated banks or post offices, ensuring ease of access and management.

Contributions and Deposits

The scheme mandates a minimum annual deposit, ensuring consistent contributions towards the account. While there is a maximum limit, the flexibility in deposit amounts allows parents to align their savings with their financial capabilities.

Interest Rates and Compounding

Sukanya Samriddhi Yojana offers competitive interest rates that are compounded annually. This compounding effect significantly enhances the growth of the deposited funds over the maturity period, resulting in a substantial corpus.

Withdrawal Rules and Guidelines

The scheme allows partial withdrawals for specific purposes, such as higher education or marriage expenses of the account holder. This provision ensures that the accumulated savings can be strategically utilized to meet important life milestones.

Impact and Success Stories

The Sukanya Samriddhi Yojana has garnered widespread acclaim for its positive impact on girl child education and empowerment. Numerous success stories highlight how the scheme has played a pivotal role in facilitating higher education and enabling young girls to pursue their dreams.

Comparison with Other Investment Options

When compared to other investment avenues, Sukanya Samriddhi Yojana stands out as a purpose-built platform for securing the financial future of girl children. Its combination of high interest rates, tax benefits, and long-term growth potential makes it a compelling choice for parents and guardians.

The Lock-in Period

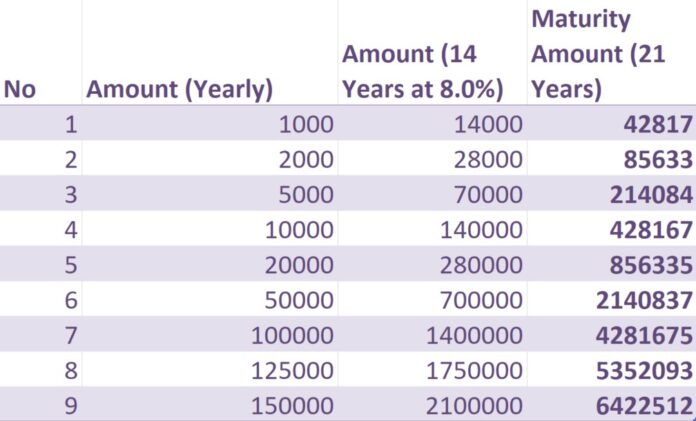

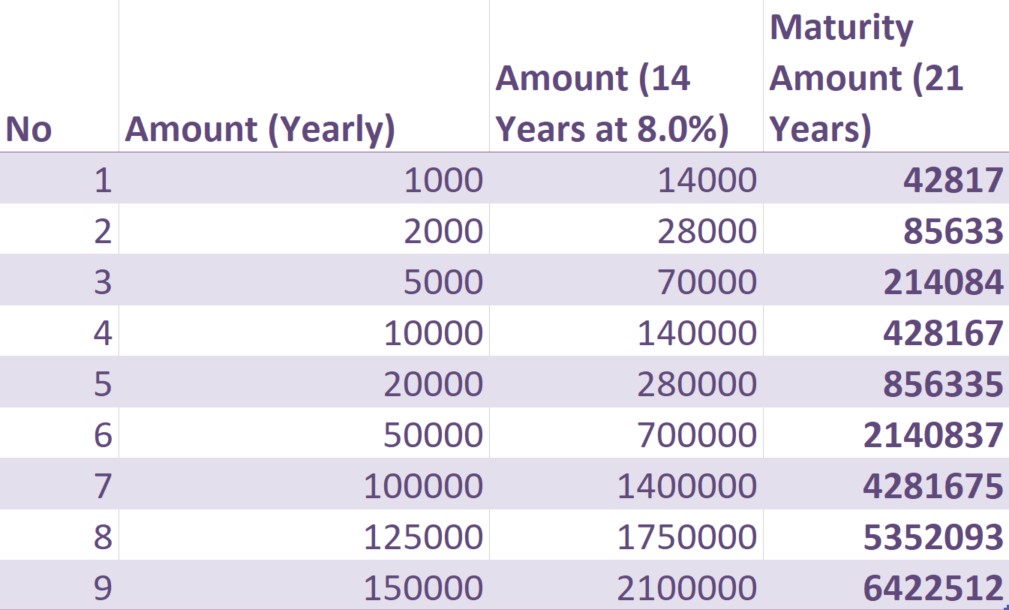

Sukanya Samriddhi Yojana comes with a lock-in period of 21 years. During the initial 14 years, a minimum annual investment of ₹250 is required to keep the account active, with a maximum investment limit of ₹1,50,000 per financial year. However, from the 15th year onward, investors have the flexibility to choose not to make further deposits while still earning returns on their previous investments. The maturity amount comprises the cumulative interest earned and the net investments.

Utilizing the SSY Calculator

The Sukanya Samriddhi Yojana calculator proves to be an invaluable tool for those considering this investment. Calculating potential maturity amounts manually can be cumbersome and prone to errors. The SSY calculator streamlines this process by providing accurate results swiftly, eliminating the need for complex calculations.

The calculator not only estimates the maturity amount but also aids in determining the necessary regular contributions to achieve specific financial goals. It offers a user-friendly online interface and is available free of charge, making it accessible and convenient for all prospective investors.

Advantages of Using the Calculator

The benefits of utilizing the Sukanya Samriddhi Yojana calculator are numerous:

1. Instant Computation: The calculator rapidly computes interest earned and maturity amounts.

2. Error Elimination: Manual calculation errors are eliminated, ensuring precise figures.

3. Flexibility: It accounts for both yearly and monthly contribution scenarios.

4. Financial Planning: The calculator aids in planning for education, healthcare, career, and marriage expenses.

5. User-Friendly: Accessible online, it’s easy to use from the comfort of your home.

How to Use the Calculator

Using the SSY calculator is straightforward:

1. Enter the girl child’s age (within the maximum of 10 years, with a 1-year grace period).

2. Input the yearly investment amount (ranging from ₹250 to ₹1,50,000).

3. Adjust the investment starting year using the slider.

The calculator then displays the maturity year, accrued interest, and the final maturity amount based on the provided information.

Unlocking the Potential of Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana empowers parents to shape a secure future for their girl child. Beyond the lock-in period, this scheme offers a high-interest rate and tax benefits. By utilizing the SSY calculator, investors can strategically plan their finances, ensuring their daughter’s aspirations are met, and financial worries are minimized.

In a world of uncertainties, Sukanya Samriddhi Yojana and its calculator provide a dependable path to securing your daughter’s financial well-being. Invest wisely, plan ahead, and unlock a world of opportunities for your girl child’s future.

Conclusion

In a nation that values the education and empowerment of girls, Sukanya Samriddhi Yojana has emerged as a transformative initiative. By providing a structured and disciplined approach to savings, the scheme empowers parents to invest in their daughters’ future with confidence. Through attractive interest rates, tax benefits, and a focus on long-term growth, Sukanya Samriddhi Yojana paves the way for a brighter and more prosperous tomorrow for young girls across India.

—

Frequently Asked Questions (FAQs)

1. Can the scheme be availed for more than one girl child in a family?

– Yes, the scheme can be availed for a maximum of two girl children in a family.

2. What happens if the minimum annual deposit is not made?

– Failure to make the minimum annual deposit may attract penalties. It is advisable to contribute regularly to maximize the benefits of the scheme.

3. Is premature withdrawal possible?

– Premature withdrawals are allowed under specific circumstances, such as the girl child’s marriage or higher education needs.

4. What happens if the girl child’s age exceeds ten years during account management?

– The scheme is applicable for girl children below ten years of age, with a grace period of one year. Once the account is opened, it can continue to operate even if the girl’s age exceeds ten.

5. Are NRIs eligible to open a Sukanya Samriddhi account?

– Yes, both resident and non-resident Indians are eligible to open an account under this scheme

6. What happens if the minimum annual deposit is not made during the lock-in period?

– Failure to meet the minimum deposit requirement may result in penalties. Consistent contributions are advised for optimal scheme benefits.

7. Is premature withdrawal possible during the lock-in period?

– Premature withdrawals are permitted under specific circumstances, such as the girl child’s higher education or marriage expenses.

8. Is the Sukanya Samriddhi Yojana calculator user-friendly?

– Absolutely, the online calculator offers an intuitive interface, making it easily accessible and convenient for all prospective investors.